With over 22 years of expertise in Vancouver’s luxury market and international investment experience in Mexico, I'll help you find not just a property, but a space that truly supports your lifestyle, values, and future vision.

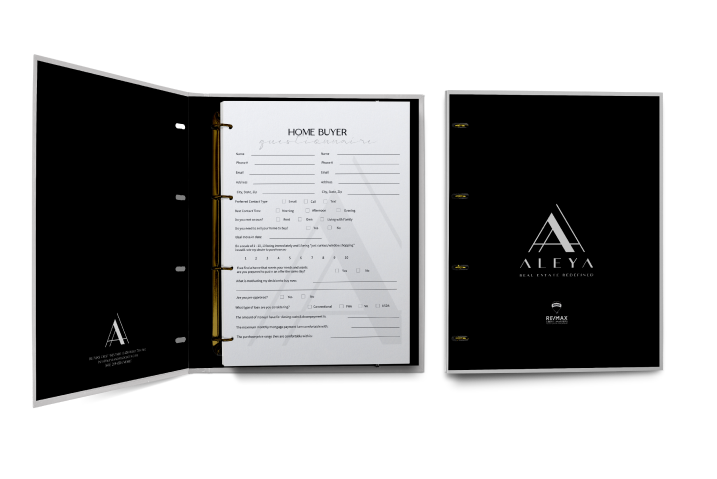

Aleya's Step by Step Home Buying Process in Vancouver

- Personalized Consultation

We start by understanding your goals, lifestyle, and desired community. From feng shui principles to smart-home must-haves, your search is tailored to your unique needs.

- Exclusive Access

Leveraging deep local relationships and international networks, Aleya uncovers on- and off-market opportunities others can’t.

- Concierge Guidance

From pre-approval to closing, every detail is supported by a trusted circle of mortgage experts, legal advisors, designers, and wellness consultants.

- Future-Focused Strategy

Whether you’re planting roots, growing your portfolio, or investing internationally, every decision is made with both immediate value and long-term growth in mind.

I believe in efficiency and sustainability.

Professionalism, Quality, Responsiveness

Our experience with having Aleya as our realtor was phenomenal...The entire team at Aleya & Associates were super patient and understanding of our needs and wants, They were always very responsive whenever we had a question no mater how big or small and always made us feel that we were their top priority...Aleya completely exceeded our expectations and her honesty and huge heart shined through day after day especially when we would start feeling defeated at times looking for our perfect dream home...I’m happy to say I now live right on a golf course with a beautiful view that would have never been possible without the help and strategic guidance of Aleya and Associates.

I highly highly recommend anyone to use them in their next purchase or selling of their home.

Professional, Efficient, Supportive

I would highly recommend Aleya. She is professional and gets things done quickly and efficiently, and is also very supportive throughout the entire process. She sold my condo in 7 days and then helped me navigate the current tricky market to find a wonderful new condo. She is amazing!!!

Exceptional, Expert in Marketing

Aleya is an exceptional real estate agent that I have had the pleasure of working with. Her attention to detail, care for clients, and marketing expertise are second to none. I would recommend her to anyone who is looking for a realtor who would work for them and have their best interest at heart around the clock. I look forward to completing many more transactions with her in the future!

Knowledgeable, Personable, Professional

We would highly recommend Aleya Bhaloo. When a personal situation required us to move to another province, we were overwhelmed with the task of selling our home and organizing a move on a quick timeline. Aleya and her team worked around the clock to get our home into good shape and sold above our asking price within a week from listing, despite the challenges of the pandemic. She is personable, professional and extremely knowledgeable.

CLIENT REVIEWS

.png)

Kris

YALETOWN, VANCOUVER“No words can explain how grateful I am to have had Aleya and her team behind me for the sale of my condo and the purchase of my new home. As a first time seller I had no idea what to expect or do, but Aleya was with me every step of the way, making the entire process almost stress free…”

.png)

Ken MacIntyre

YALETOWN, VANCOUVER“I started working with Aleya 6 years ago when she helped me buy my last condo. We just sold that same condo in five days, no muss no fuss, Aleya and her team had it all covered and I would highly recommend her to anyone looking for an easy going and efficient realtor…”

.png)

Shanel Pratap

YALETOWN, VANCOUVER“After helping me sell my townhome - Aleya and her staff was very diligent in assisting me find, and buy my next home. Not only did they constantly check in with me, about my needs, wants and pricing, but helped by sending me countless leads on potential places. While the market was out of control…”

.png)

Alexis Law

YALETOWN, VANCOUVER“Aleya is professional, caring and very knowledgable. She assisted me in purchasing my first home in Vancouver! Buying a property can be a stressful process; however, Aleya ensured that I was presented with high quality choices and insightful feedback on each property that we visited…”

.png)

Eric S

YALETOWN, VANCOUVER“I met Aleya a few years back at a networking event and told her I was pondering buying a condo in Yaletown within a couple of years as an investment property. She was very tentative to my needs and wants for a rental property and extremely patient with me as well. Since then I have bought a unit from her…”

.png)

Jacquie Sutton

YALETOWN, VANCOUVER“Aleya is knowledgeable and professional. She and her team did a great job and made my experience as stress free as possible…”

.png)

Susan Matheson

YALETOWN, VANCOUVER“I would highly recommend Aleya. She is professional and gets things done quickly and efficiently, and is also very supportive throughout the entire process. She sold my condo in 7 days and then helped me navigate the current tricky market to find a wonderful new condo. She is amazing…”

.png)

Neb Curcin

YALETOWN, VANCOUVER“Aleya is an exceptional real estate agent that I have had the pleasure of working with. Her attention to detail, care for clients, and marketing expertise are second to none. I would recommend her to anyone who is looking for a realtor who would work for them and have their best interest at heart around the clock. I look forward to completing many more transactions with her in the future…”

.png)

Elle Fish

YALETOWN, VANCOUVER“We would highly recommend Aleya Bhaloo. When a personal situation required us to move to another province, we were overwhelmed with the task of selling our home and organizing a move on a quick timeline. Aleya and her team worked around the clock to get our home into good shape and sold above our asking price…”

.png)

Carrie cade

YALETOWN, VANCOUVER“Aleya is extremely knowledgeable, personable and professional. She pays attention to every detail and goes above and beyond for her clients. Buying or selling, she’s your go to realtor…”

.png)

Nizar Jetha

YALETOWN, VANCOUVER“Both Tiffany and Aleya did a wonderful job marketing our property and kept us fully informed at every stage of the process. Both, Tiffany and Aleya exhibited. professionalism of the highest calibre…”

%20(1).png)

ALEYA BHALOO

1152 Mainland street #130 Vancouver BC V6B 4X2

® 2023. Aleya Real Estate Redefined. All rights reserved. Sitemap | Real Estate Website Design by Zinda Agency.